Understanding Solo 401(k) Plans: Advantages and Withdrawal Guidelines

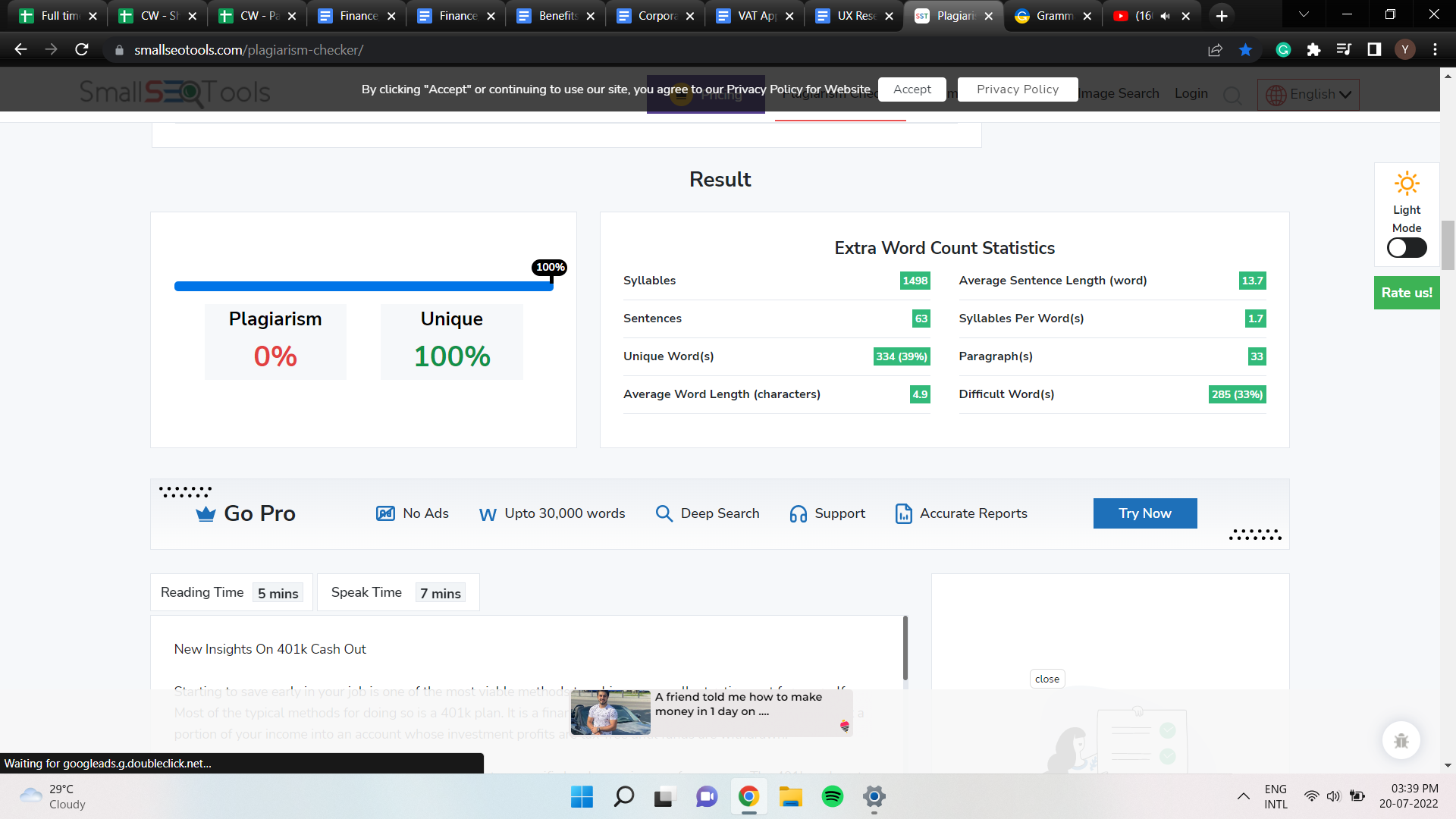

Discover the benefits and rules of Solo 401(k) plans, ideal for self-employed professionals. Learn about contribution limits, tax advantages, withdrawal conditions, and essential deadlines for establishing and funding these retirement accounts, offering flexible and tax-efficient retirement savings options tailored to independents and small business owners.

Sponsored

Understanding Solo 401(k) Plans: Advantages and Withdrawal Guidelines

What is a Solo 401(k)?

Also known as an individual 401(k), this retirement savings plan is approved under Internal Revenue Code Section 401. It’s tailored for self-employed individuals and sole proprietors. Similar to traditional IRAs, it provides cost-effective, tax-advantaged investment opportunities with added benefits. Suitable for freelancers, consultants, real estate professionals, and others, this plan can be funded via rollovers from existing IRAs, SEP, 401(k), profit sharing, or other qualified plans.

Funding can be made through establishing a new trust or transferring assets to an existing custodian account.

Key benefits of a Solo 401(k):

Contributions reduce taxable income and investments grow tax-deferred until retirement. Assets remain tax-free until withdrawal.

Because the plan is tailored by the owner, administration is simpler compared to traditional plans.

No need to file IRS Form 5500 unless the account exceeds $250,000.

Immediate vesting applies; there’s no vesting schedule like traditional plans.

Additional contributions can be made by including a spouse or partner as part of the business.

Funding options include salary deferrals and profit sharing. Participants can choose investment strategies independently of contribution schedules.

The plan allows for tax-free loans under specific conditions.

Withdrawal rules:

Withdrawals are permitted upon retirement or ending employment.

Withdrawals before age 59.5 incur a 10% penalty.

Non-RMD distributions, hardship withdrawals, or rollovers are subject to 20% withholding tax.

Owners with more than 5% stake must start RMDs at age 70.5; failure results in a 50% penalty on distributions.

Contribution limits for 2017 are $54,000 (or $60,000 for those over 60).

Filing IRS Form 5500 is required if assets reach or exceed $250,000.

Funding deadlines:

Solo 401(k) setup deadline: December 31 or fiscal year-end.

Salary deferral deadline: End of the business’s tax year.

Profit sharing contributions: Tax filing deadline, including extensions.