Smart Strategies for Paying Off Your Mortgage Early

Learn effective strategies to pay off your mortgage early. Discover how disciplined savings, clear communication with lenders, and leveraging increased income can help reduce your debt faster and save on interest expenses. This guide offers practical tips to achieve mortgage clearance sooner, ensuring a more secure financial future.

Sponsored

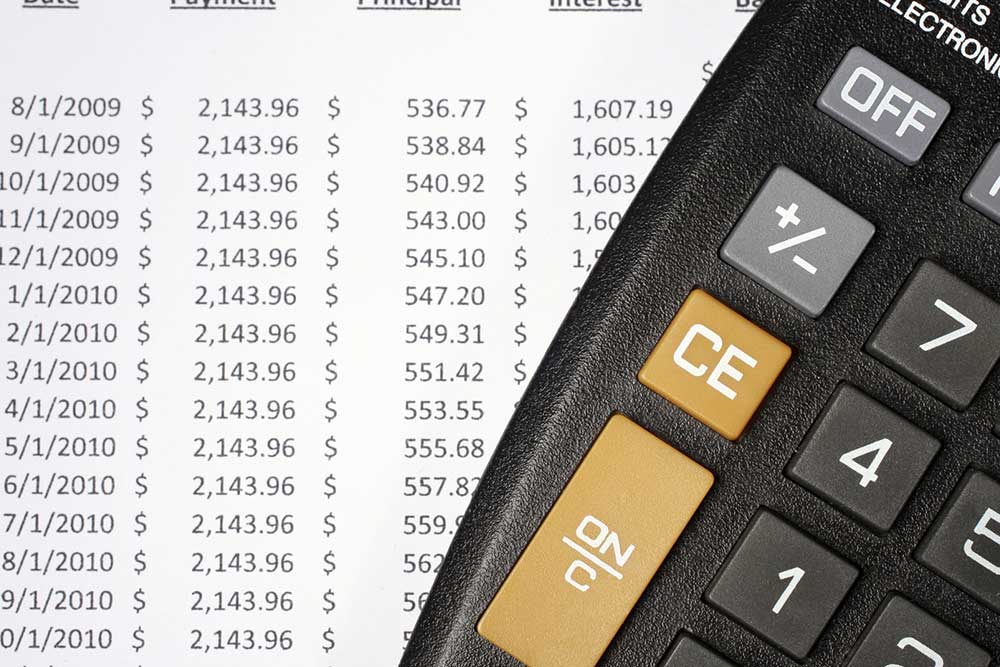

Managing a mortgage—from application to timely repayment—is a challenging process. A large portion of income often goes toward monthly installments, leaving little for personal expenses. Effective planning can enable borrowers to reduce their loan tenure while managing daily costs. Paying off a mortgage early relieves debt sooner and allows funds to be redirected into other investments, securing your financial future.

However, early repayment requires disciplined savings and financial foresight. It’s essential to allocate extra funds regularly, ensuring sufficient reserves for unforeseen expenses. Confirming with your lender about prepayment policies helps avoid misunderstandings. Increased earnings can also be used to refinance for shorter terms or make additional annual payments, accelerating repayment. While prepaying may require lifestyle adjustments, the long-term benefits include reduced interest costs and financial freedom.