Essential Guide to W-2 Tax Forms for Employers and Employees

Learn everything about W-2 tax forms—what they include, how to get them, and the corrections process. Essential for employers and employees for accurate tax reporting and compliance.

Sponsored

Key Information About W-2 Tax Documentation

A W-2 form is a crucial document that employers prepare annually for their workers. It details earnings such as wages, Social Security, and Medicare contributions. The form also records federal and state tax deductions. Employees should review their W-2s carefully each year to verify accurate withholding and ensure they receive the correct refund or payment.

Components of the W-2 Form

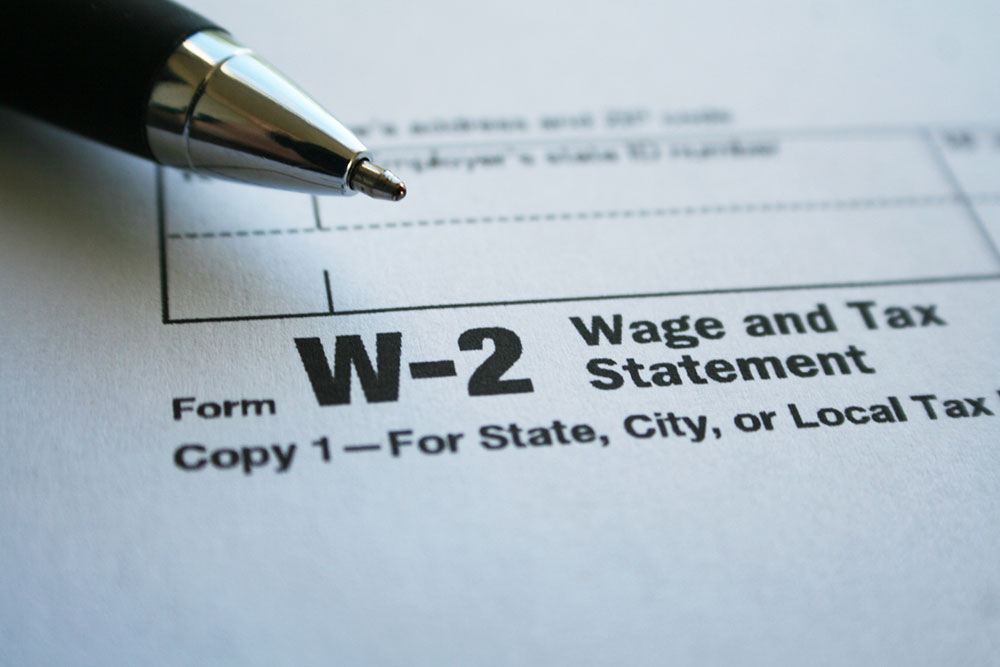

W-2 forms consist of several copies serving different purposes:

Copy A is submitted to the Social Security Administration (SSA).

This is printed on a special laser-readable red sheet for SSA processing. Paper forms should only be obtained through official channels.

Copy 1 goes to local and state tax agencies.

Copy B is used for federal tax filing.

Copy C is kept for employee records.

Copy 2 is for local tax authorities.

Copy D remains with the employer's records.

Where to Obtain W-2 Forms

W-2 forms are not available online for copying. The SSA prints the official forms on specialized paper that scanners read. Employers should contact their tax preparer or official sources to get these forms for filing purposes.

To complete W-2 forms properly, certain details are necessary. This includes your business name, address, Employer Identification Number (EIN), and state tax ID. Employee-specific info like Social Security Number, name, and address are also required. The form reports total wages, taxes withheld, Medicare wages, and Social Security tips from the previous year. Sections 12 and 13 document retirement plans and employee benefits.

If errors are found in a W-2, review for common mistakes before submitting. If a mistake slips through, fill out Form W-2c to correct the errors and resubmit along with Form W-3 before the deadline to ensure proper processing.