Comprehensive Guide to IRA Retirement Savings Options

Explore comprehensive insights into IRA retirement plans, including traditional, Roth, SEP, and Simple IRAs. Learn how these accounts work, their tax benefits, and suitability for your retirement goals. This guide helps individuals understand their options for secure financial planning post-retirement.

Sponsored

Understanding IRA Retirement Savings Plans

Retirement savings accounts are designed to help individuals accumulate funds for their future after ceasing work. These plans can be sponsored by employers, government agencies, insurance providers, or unions. Tax advantages often accompany these investments, regulated by the Internal Revenue Code (IRC) and overseen by the Department of Labor under the ERISA Act. Retirement plans are primarily categorized into defined benefit and defined contribution schemes, depending on payout structures, investment choices, and benefit delivery methods.

What defines a contribution-focused retirement plan? Employees select investment assets like mutual funds, stocks, or securities, with a portion of earnings diverted toward retirement savings. Examples include IRAs, 401(k)s, and profit-sharing schemes, all offering tax benefits if funds are not withdrawn prematurely, which incurs penalties.

What is an IRA? An Individual Retirement Account (IRA) is a savings vehicle allowing workers to manage retirement funds with potential tax advantages. IRAs come in various forms to suit different financial goals.

Types of IRAs include:

Traditional IRAs: Contributions may be tax-deductible, and earnings grow tax-deferred until withdrawal, offering flexibility to lower your tax bill during retirement. However, mandatory minimum distributions begin at age 70.5.

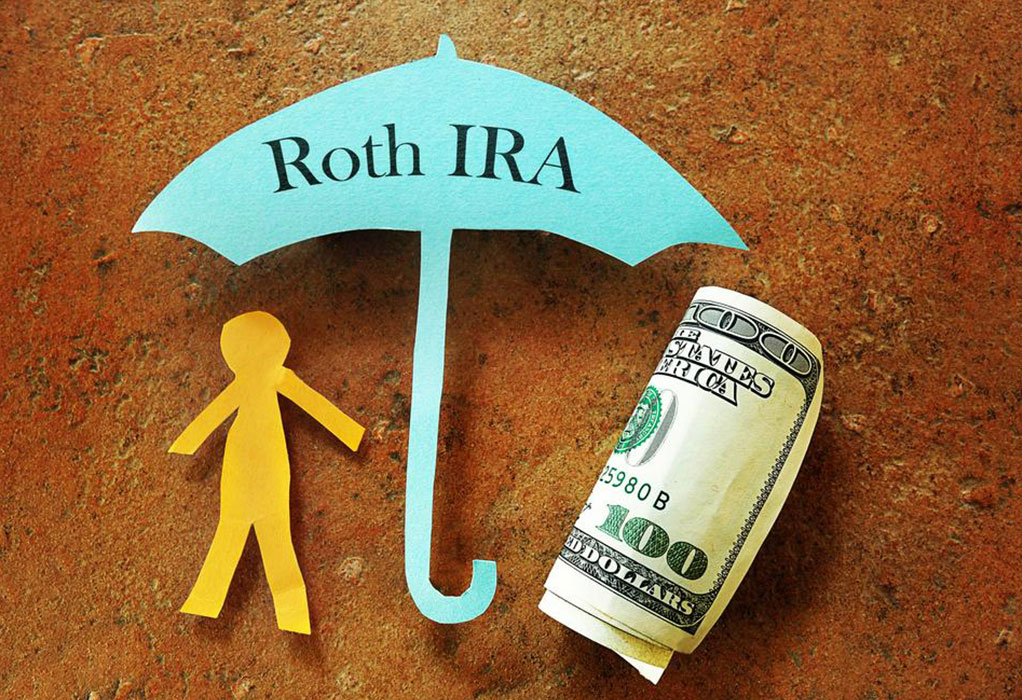

Roth IRAs: Funded with taxed income, these accounts permit tax-free withdrawals if certain conditions are met, making them ideal for tax planning. Contributions are optional, but qualified distributions are tax-free.

SEP IRAs: Sponsored by employers, these plans are suitable for small businesses and self-employed individuals, with tax advantages on employer contributions.

Simple IRAs: Designed for small firms and self-employed workers, these accounts involve employee salary deferrals on a pre-tax basis, with tax deferred until withdrawal.