Smart Tax Strategies for Seniors and Families

Optimize your financial future with smart tax-saving strategies tailored for seniors and families. Learn about short-term investments, Roth IRAs, 529 plans, health insurance, and family pooling investments to maximize savings and reduce tax burdens. Stay informed with expert advice and the latest tax updates to make the most of your retirement and family funds.

Sponsored

Effective Tax Strategies for Seniors and Families

For mature families, optimizing tax savings involves scrutinizing your investment portfolio. Reviewing all your investments helps identify the most tax-efficient options. Here are some essential tips to enhance your tax savings as an older family.

Opt for shorter lock-in investment periods

As retirement nears, maintaining accessible funds is crucial. Choosing investments with shorter durations may reduce returns but can offer liquidity and favorable tax treatment. Diversifying your investments ensures a balanced approach between growth and tax benefits.

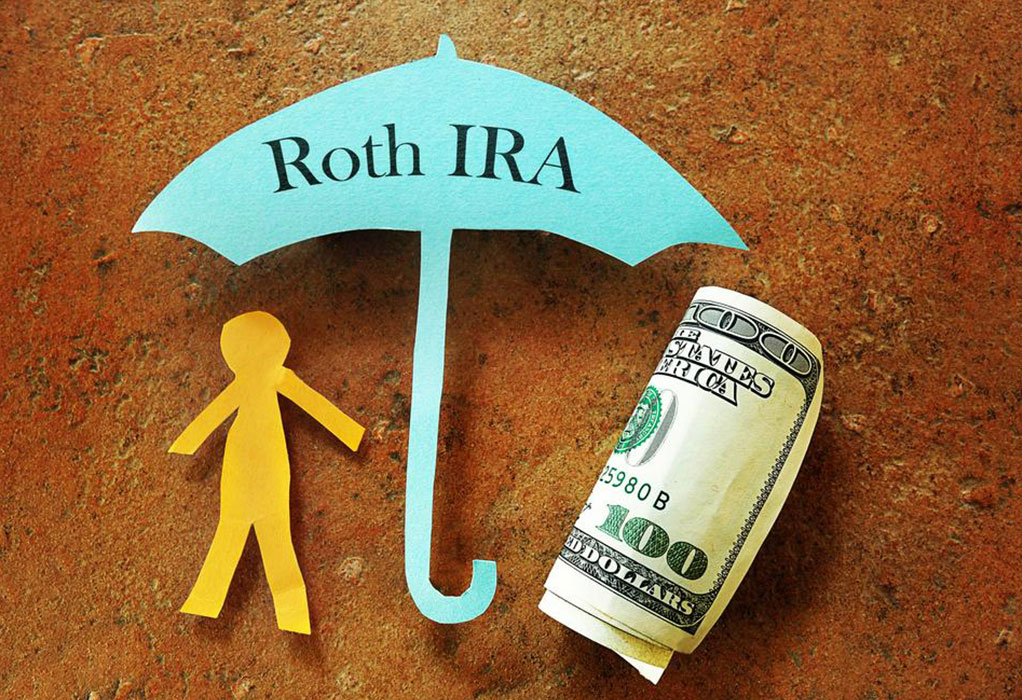

Transition your retirement savings to a Roth IRA

Roth IRAs are advantageous for retirees, as qualified withdrawals after age 59½ are tax-free. Contributions grow tax-free, and there are no mandatory withdrawals during your lifetime, provided the account is open for at least five years. This can significantly boost your tax savings in retirement.

Additional tip: Explore the 10 States with the Best Tax Policies for retirees to maximize savings.

Invest in a 529 College Savings Plan for Your Child

If your child's education is upcoming, a 529 plan can provide tax advantages while saving for tuition. This investment allows tax-free growth and withdrawals for qualified educational expenses, making it a smart choice for future financial planning.

Consider health insurance investments

Health-related expenses are a major concern for seniors. Investing in comprehensive health insurance policies can help reduce medical costs and provide tax deductions, offering financial security while minimizing taxable income.

Join family investments

Pooling resources with earning family members enables collective investments. This approach can diversify your portfolio and maximize tax exemptions, fostering better wealth growth and tax efficiency.

Consulting a financial advisor is invaluable for personalized strategies. Proper investment choices can minimize taxes while securing your financial future. Stay informed about tax updates by following us on Facebook and Twitter for the latest insights on investments and tax planning.