Understanding Loan Amortization and Its Types

Learn about loan amortization, its importance, how to create amortization tables, and explore different types like mortgages, personal, and auto loans. This guide simplifies understanding fixed payments, interest vs. principal, and loan management strategies for smarter borrowing.

Sponsored

Understanding Loan Amortization

Amortization refers to the process of gradually paying off a loan through consistent fixed payments over a specified period. While interest and principal components may fluctuate monthly, the total payment remains constant. This term also applies in accounting for allocating costs over an asset's useful life, especially for intangible assets.

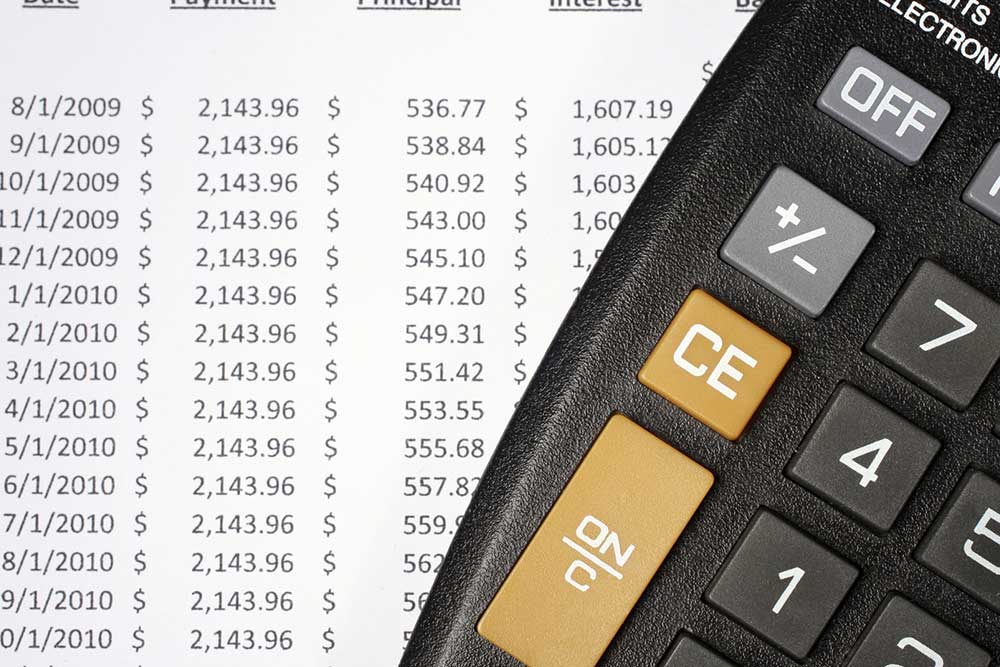

Each installment covers interest costs—what the lender earns—and reduces the principal balance. Early in the schedule, most payments go toward interest, with little impact on the principal, requiring patience and detailed understanding of your loan's structure.

Creating an amortization schedule is straightforward. You can do it manually, use online calculators, or spreadsheets designed to analyze loans and generate repayment tables.

The process involves the following steps:

Determine the initial loan amount

Compute your fixed monthly repayment

Calculate the monthly interest portion

Deduct the interest from the total payment to find the principal repayment

Reduce the loan balance accordingly

Repeat for subsequent months

Loan amortization varies depending on the type:

Mortgage Loans

Typically spanning 15 to 30 years with fixed interest rates, these loans can be paid off early through refinancing or property sale. Consistent payments help clear the debt over time.

Personal Loans

Offered by banks or online lenders, these loans are often small-scale, used for short-term needs or debt consolidation, with fixed terms usually around three years and stable interest rates.

Auto Loans