Essential Guidelines for Choosing the Right Financial Management Software

Choosing the right financial management software is crucial for business efficiency. This guide covers key considerations like data handling, automation, security, and aligning features with business needs, helping companies make informed software choices that enhance financial operations and decision-making.

Sponsored

The use of financial management software has become increasingly vital for businesses striving for efficiency. Modern companies rely heavily on digital financial tools to streamline operations, generate detailed financial reports, and accurately forecast funding needs.

Such software eliminates manual calculations, offering numerous benefits including quick data processing and enhanced decision-making. The capability to produce visual financial reports through integrated graphics tools further supports strategic planning.

Efficient Data Handling and Presentation

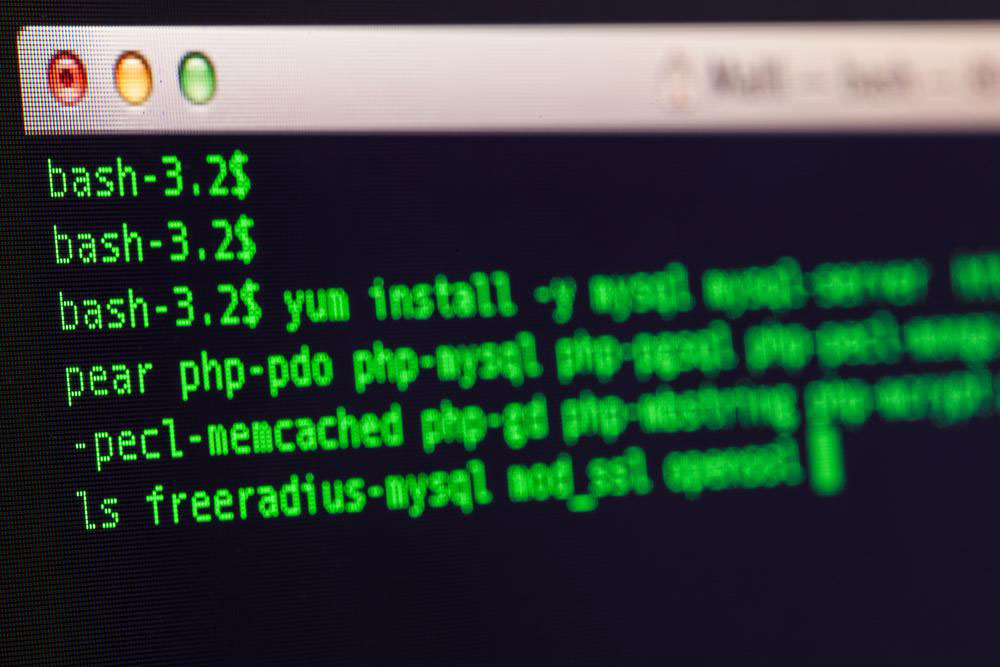

Leveraging electronic data processing, high-quality financial software enables precise management of extensive data sets, facilitating rapid and straightforward access to critical information.

Effective financial management software helps organize and analyze data efficiently, leading to better business insights. It supports timely data collection and enables visualization techniques that simplify complex financial information, empowering better decision-making.

Role of Financial Software in Modern Business

In today’s complex financial landscape, sophisticated software tools are indispensable. They promote disciplined resource management and help streamline financial processes, ensuring business stability and growth.

Understand Your Business Needs

Before selecting financial software, clarify your specific requirements and strategic goals. Identify features that align with your business objectives. Choosing software that matches these needs guarantees maximum benefits and avoids unnecessary expenses.

Evaluate Automation Capabilities

Top-tier financial programs offer automation features, simplifying tasks such as budgeting, categorization, reporting, scheduling, and tax calculations, making financial management more efficient and less prone to errors.

Consider Non-functional Features

It's essential to scrutinize security, system integration, user interface, customer support, and pricing. A thorough review ensures you select a reliable, secure, and cost-effective solution.

Careful research comparing features, reliability, speed, and scalability will help identify the most suitable financial software for your business, maximizing ROI and operational efficiency.