Understanding the Expenses of Laser Cataract Removal

Learn about the costs associated with laser cataract surgery, including factors affecting pricing, insurance coverage options, and ways to manage expenses effectively. This guide covers everything from procedure ranges to financial planning tips, ensuring patients are well-informed before opting for this advanced eye treatment.

Sponsored

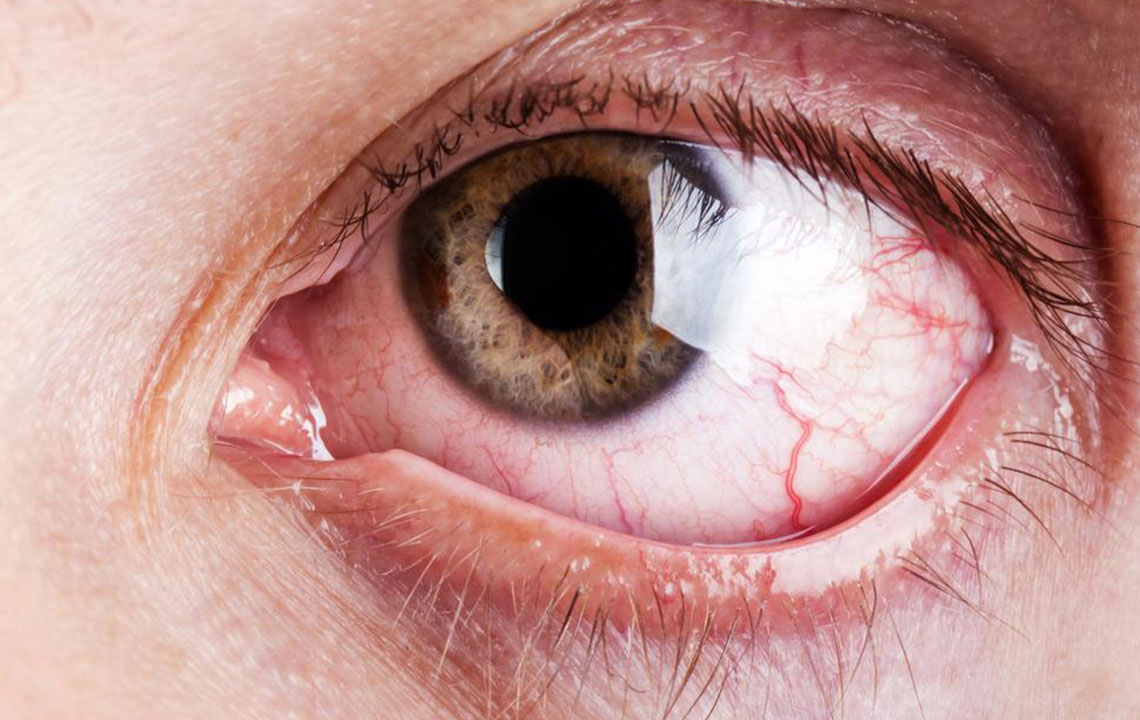

Cataracts cause cloudiness in the eye's natural lens, which is located behind the iris and pupil. The lens contains organized proteins that keep it transparent, letting light pass through. Aging can cause these proteins to clump, leading to blurry vision and sensitivity to bright lights. Other factors such as sun exposure, diabetes, smoking, certain medications, and high myopia can also contribute. If left untreated, cataracts can worsen, blocking more of the lens and impairing sight. Symptoms include dull colors and difficulty seeing clearly, especially in bright environments.

Traditional cataract surgery involves removing the clouded lens and replacing it with a synthetic one, requiring general anesthesia and a lengthy recovery. Since the 1960s, ultrasound technology has been used to break the lens into tiny fragments through small incisions with minimal healing time. The advent of laser surgery in 1999 enhanced the precision of lens shaping and treatment of refractive errors like nearsightedness, farsightedness, and astigmatism.

Laser cataract removal costs typically range from $1500 to $3000 per eye, depending on factors like the technology used, eye condition, and overall health. Procedures utilizing advanced wavefront laser technology tend to be more expensive. Some clinics offer warranty plans, either for a year or lifetime, which vary in pricing. Bladeless surgeries, which employ femtosecond lasers, usually cost about $200 more per eye.

Most insurance plans, including Medicare and private insurers, cover laser cataract surgery, especially for patients over 60. Many financial institutions also provide installment or fixed-rate plans for elective procedures like LASIK. Coverage specifics, including deductibles and lens choices, influence the out-of-pocket costs. Patients without insurance must pay the full procedure cost, which varies based on local fees and surgeon rates.

Before surgery, consulting with your insurance provider or Medicare representative is essential to clarify coverage details, including co-pays, deductibles, and approval requirements. Important questions include whether glasses are covered, if the surgical center is preferred, and if prior approval is necessary. To reduce costs, consider using a Flexible Spending Account (FSA) or a Health Savings Account (HSA) for pre-tax payments, especially if your employer offers these options. Unused HSA funds can be rolled over for future use, helping manage expenses efficiently.